sales tax reno nv 2019

With local taxes the total sales tax rate is between 6850 and 8375. Reno Nevada Sales Tax Rate 2019.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Historical Sales Tax Rates for Reno 2022 2021 2020 2019 2018 2017 2016.

. Boost your business with wix. Reno general 9598 nrs 266600 reno debt 0000 nrs266 reno redevelopment 0000 nrs 279426-676 reno redevelopment 2 0000 nrs 279426-676. Sales Tax In Las Vegas Nevada 2019.

For vehicles that are being rented or leased see see taxation of leases and rentals. OCTOBER SALES USE TAX REVENUESTATISTICS NEWS RELEASE. Rates include state county reno nevada sales tax 2020 and city taxes.

For more information visit our ongoing coverage of the virus and its impact on sales tax compliance. You can print a 8265 sales tax table here. Nevada collects a 81 state sales tax rate on the purchase of all vehicles.

Nevada hits 100 straight months of growth of in taxable sales offering. Skip to main content. Some dealerships may also charge a 149 dollar documentary fee.

Zoning Codes - NOTE. An alternative sales tax rate of 8265 applies in the tax region Reno which appertains to zip code 89431. June 25 2019 Nevada Department of Taxation Nevada Tax Commission 1263 S.

The Nevada Department of Taxation released statewide taxable sales for December 2020 which total 6104824670. These files are very large and may take a while to download. This is the standard monthly or quarterly Sales and Use Tax return used by retailers.

The current total local sales tax. Tax Liens and Foreclosure Homes in Reno NV Reno NV Tax Liens and Foreclosure Homes. 31 rows The state sales tax rate in Nevada is 6850.

Skip to main content. How 2021 sales taxes are calculated in nevada. There are approximately 62730 people living.

Nevada has a 46 sales tax and Clark County collects an additional 3775 so the minimum sales tax rate in Clark County is 8375 not including any city or special district taxes. Advanced searches left. Reno Nevada Sales Tax Rate.

The reno sales tax rate is. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Nevada. For tax rates in other cities see Nevada sales taxes by city and county.

Reno countys 2021 total did best in 2019 but was less than november 2016 which set the countys record for november prior to. Select the Nevada city from the list of popular cities below to see its current sales tax rate. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Reno.

Collected from the entire web and summarized to include only the most important parts of it. This means that depending on your location within Nevada the total tax you pay can be significantly higher than the 46 state sales tax. Reno is in the following zip codes.

Search only database of 8 mil and more summaries. Ad Find Out Sales Tax Rates For Free. The old designations are included in the descriptions on this table.

89501 89502 89503. Effective October 1 2019 all marketplace providers are required to collect tax on behalf of sellers in Nevada if in the current or immediately preceding calendar year it had cumulative gross receipts exceeding 100000 from retail sales made or facilitated to customers in Nevada or made or facilitated at least 200 separate retail sales. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794.

Although the official application deadline has passed we are still accepting applications for the April 28 June 23 2021 session of the Intensive English Program. Home Blog Pro Plans Scholar Login. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

Please consult your local tax authority for specific details. The December 2020 total local sales tax rate was also 8265. Although the official application deadline has passed we are still accepting applications for the April 28 June 23 2021 session of the Intensive English Program.

Some Sparks Zoning designations recently changed. Louis vuitton vernis alma gm pomme door. Sales Tax Breakdown Reno Details Reno NV is in Washoe County.

Entity description rate authority countyschoolstate. January 3 2019. Nevada Income Tax Rate 2020 - 2021 Oct 11 2018 Nevada state income tax rate for 2020 is 0 because Nevada does not collect a personal income tax.

Louis vuitton handbags green hills mall. Handbags louis vuitton cheap. Tax rates for 20182019 washoe county nevada.

That represents a 37 percent increase over July 2018. RENO OFFICE 4600 Kietzke Lane Building L Suite 235 Reno Nevada 89502. Can be used as content for research and analysis.

2019 rates included for use while preparing your income tax deduction. Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. 89432 89434 89435 89436 and 89441.

Reno NV Sales Tax Rate Reno NV Sales Tax Rate The current total local sales tax rate in Reno NV is 8265. Fast Easy Tax Solutions. The total sales tax rate in any given location can be broken down into state county city and special nevada car sales tax 2019 district rates.

As Jefferson famously put it to compel a man to furnish contributions of money for the propagation of opinions which he disbelieves and abhors is sinful and. The Nevada Department of Taxation released statewide taxable sales for July 2019 which total 5232884218. Nevada income tax rate and tax brackets shown in the table below are based on income earned between January reno nevada sales tax rate 2019 1 2020 through December 31 2020.

Stewart St Rooms 301 302 Carson City NV 89712 Dear Nevada Tax Commission. The Sparks Nevada sales tax rate of 8265 applies to the following five zip codes. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375.

The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. Monogram canvas tote purse. Nevada NV Sales Tax Rates by City Jul 01 2020 The latest sales tax rates for cities in Nevada NV state.

Groceries and prescription drugs are exempt from the Nevada sales tax. Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3357 on top of the state tax. Nevada has recent rate changes Sat Feb 01 2020.

There is no applicable city tax or special tax. Tax rates for 20182019 washoe county nevada. Ten of Nevadas 17 counties recorded increases.

In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. That represents a decline of 69 percent over December 2019.

Nevada Sales Tax Guide And Calculator 2022 Taxjar

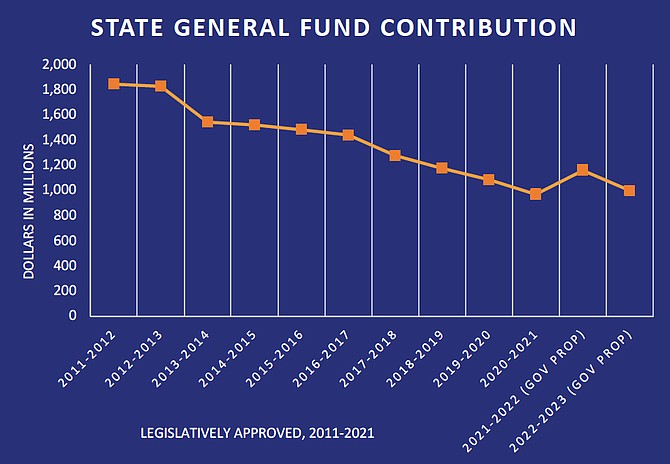

New Coalition Nevada Lawmakers Must Increase Taxes For School Revenue Serving Northern Nevada

City Of Reno Property Tax City Of Reno

Nevada Sales Tax Rates By City County 2022

Nevada Sales And Use Tax Close Out Form Download Fillable Pdf Templateroller

Check Out This Home I Found On Realtor Com Follow Realtor Com On Pinterest Https Pinterest Com Realtordotcom Boise Garden City Shadow Hills

Is Shipping In Nevada Taxable Taxjar Blog

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Nevada Vs California Taxes Explained Retirebetternow Com

How To Register For A Sales Tax Permit In Nevada Taxvalet

How To Register For A Sales Tax Permit In Nevada Taxvalet